Powerful, easy-to-use accounting software that has everything you need to confidently run your business. As a church owner, you know that providing the best environment to your congregation not only includes offering your support but making sure your finances are “in the black”. Afterall, you want to offer new events, keep up with repairs and make sure the lights stay on.

AccountEdge Pro

- It is also best for churches that use separate HR and payroll software or that have few employees for whom they must process payroll.

- A bookkeeper can also give you insight into your cash flow (and you can get started with instant insights with Nav’s Cash Flow Tool).

- For example, a church may receive a large donation from one of its members.

- Adopting tools and systems that will customize, energize and facilitate ministry in all church settings includes ensuring you have the best small-church accounting software.

Bookkeeping is a crucial function of accounting, and earning a bookkeeping certification is a great way to show employers your expertise. While a certificate is not a requirement to become a bookkeeper, some professionals pursue certification to show their skills to employers and stand out in their job search. A few employers offer on-the-job training for bookkeepers https://www.simple-accounting.org/ by providing internships and placement programs. According to the US Bureau of Labor Statistics (BLS), most bookkeepers can learn the profession’s basics in about six months [3]. Once you become a qualified bookkeeper, you can work as a permanent employee or freelancer. Managing the general ledger is part of your daily responsibilities as a bookkeeper.

Church accounting software made for your ministry

Look for accounting software that is user-friendly and easy to navigate. The software should have an intuitive interface and provide clear instructions. Before we dive into the specifics of the top accounting software for small churches, let’s take a closer look at what accounting software is and what it can do for your church. First off, there’s QuickBooks, the gold standard in accounting software. The program is a popular solution for accounting professionals, as well as those who are self-taught.

Can I do my own bookkeeping for my business?

FreshBooks ensures you spend less time worrying about your church’s accounting and more time helping people in the community. Create customized invoices for tax receipts and private events in a matter of minutes. Add a personalized thank-you note and send the invoice directly from your account.

Church Management (ChMS)

Especially one that recalibrates and redefines the status quo of our culture! When this happens, the church can play a pivotal role in spreading the Gospel, making disciples, and influencing the different areas of society that will significantly impact the 21st century. Adopting tools and systems that will customize, energize and facilitate ministry in all church settings includes ensuring you have the best small-church accounting software. While it takes a lot of prayers and planning to fulfill the vision, it also requires money to fuel it.

They can assign every dollar to a committee, program, or worship fund. Offerings can be received online or in-person, using credit card, debit card, or ACH bank transfers. QuickBooks for Church offers the ability to tag donor dollars for a committee, program or worship fund. The restricted fund dashboard gives the name of the donor, the ministry or project the donation is intended for, the donor’s contact information and the donation amount. Donors can send restricted funds via credit or debit card, ACH transfers, online or off-line. Expense tagging then allows churches to account for where donor dollars are spent.

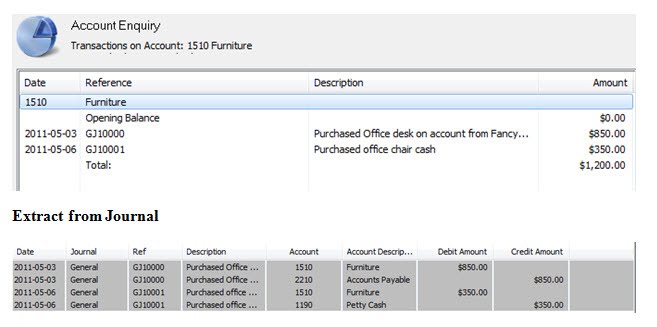

Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Another type of accounting method is the accrual-based accounting method. This method records both invoices and bills even if they haven’t been paid yet.

It doesn’t have church-specific functionality, which is the reason why it has a low score in church features. Ease of use is its best feature because it’s easy and simple to use even for non-accountants. Aplos gets the highest rating in our evaluation, but it’s not far from its competitors, 20 types of journals to keep IconCMO and QuickBooks Online Plus. In our rubric, Aplos takes the lead in ease of use because of its intuitive interface. Like IconCMO and PowerChurch Plus, Aplos gets a perfect score in church features, which we already expected given Aplos’ comprehensive church management features.

Any connections between you, your bank accounts, and Wave are protected by 256-bit SSL encryption. If you’re interested in our payroll software, you can start a free 30-day trial when you sign up for Wave. The important work your church does changes with the needs of your community.

For the information to be reported as a financial statement, it needs to be identified, accepted, classified, and recorded. Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries. Financial institutions, investors, and the government need accurate bookkeeping accounting to make better lending and investing decisions. Bookkeeping accuracy and reliability are essential for businesses to succeed for staff, executives, customers, and partners.

Merritt Bookkeeping is a no-frills Quickbooks virtual bookkeeping services firm that offers fixed, flexible pricing and an easy user interface to small business owners. They also offer a 90-day money back guarantee and are very proud of their public reviews. Since the information gathered in bookkeeping is used by accountants and business owners, it is the basis of all the financial statements generated. Most accounting software allows https://www.accountingcoaching.online/amortization-accountingtools-3/ you to automatically run common financial statements such as an income and expense statement, balance sheet and cash flow statement. Business owners or accountants can then use these statements to gain insight into the business’s financial health. Wave uses authentic double entry accounting software so your church expenses are accurately recorded and coded, making it easy to hand off year-end reports to your accountant at tax time.